Welcome To Our Company

Welcome to MYCREATIVESERVICES Investments

We help homeowners find creative solutions to challenging real estate situations. Our unique approach delivers more value than traditional sales while providing complete peace of mind.

What is Creative Real Estate?

Creative real estate refers to innovative purchase strategies where the buyer takes control and responsibility of a property, while the seller's financing remains in place.

Subject-To Transactions

Includes Subject-To and Seller Financing deals where the buyer services the existing mortgage, relieving the seller of further obligations.

Win-Win Solutions

These approaches create opportunities for sellers facing foreclosure, divorce, relocation, or difficulty listing traditionally.

Innovative Approach

Our strategies provide unique solutions that conventional real estate transactions cannot offer to sellers in challenging situations.

Creative Solutions

We specialize in Subject-To and Wrap transactions that often put more money in your pocket than traditional listings.

Seller Protection

Our agreements include comprehensive legal safeguards, credit protections, and full transparency at every step.

Hassle-Free Process

Skip the repairs, showings, and uncertainty. Get a guaranteed outcome with flexible closing timelines.

Our Commitment to Sellers

Maximum Sale Price

We help you obtain the highest possible sale price for your property, often exceeding what you might receive through traditional sales channels.

Quick Closing

Close in as little as 15–25 days, much faster than traditional sales which can take months to complete.

Simple and Safe

We make the process simple and safe for you and your agent, with transparent documentation and professional oversight.

Why Consider a Creative Offer?

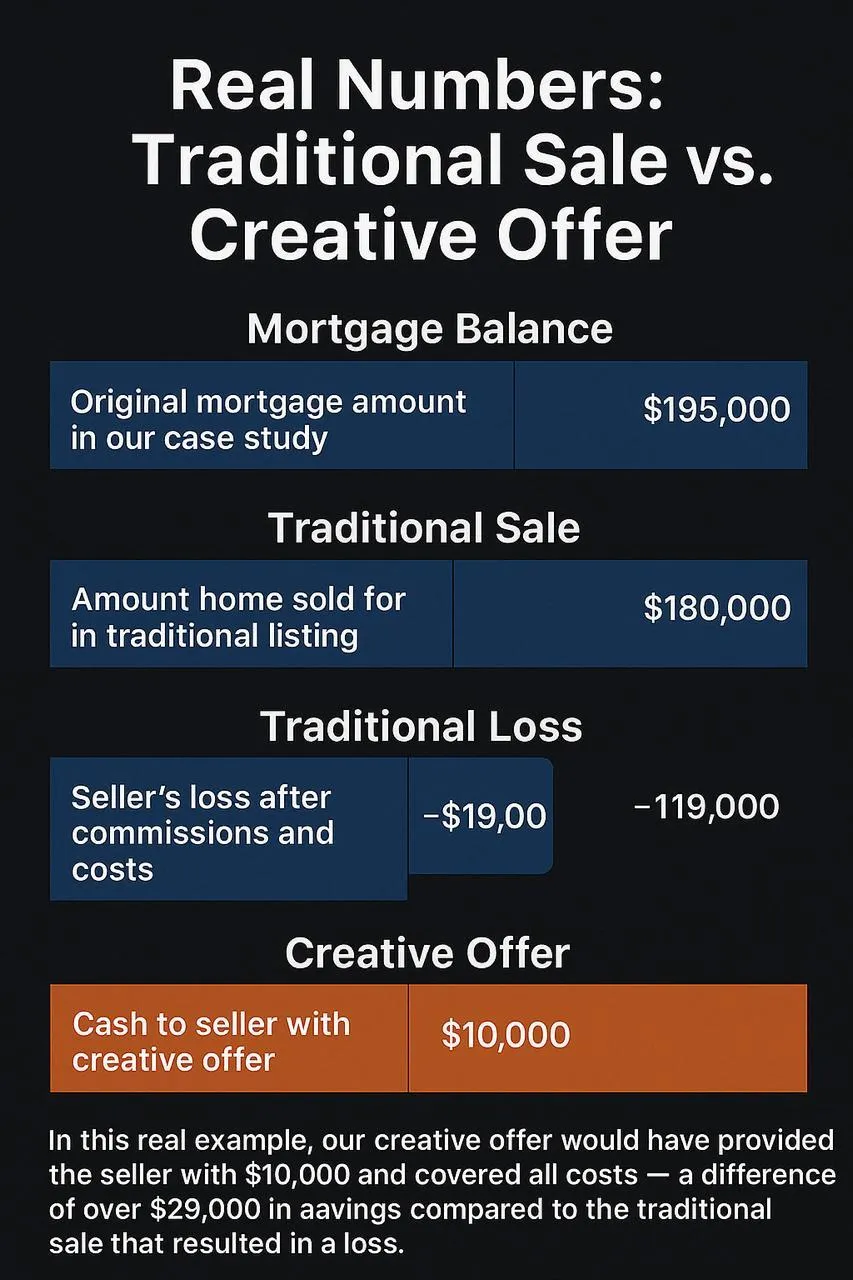

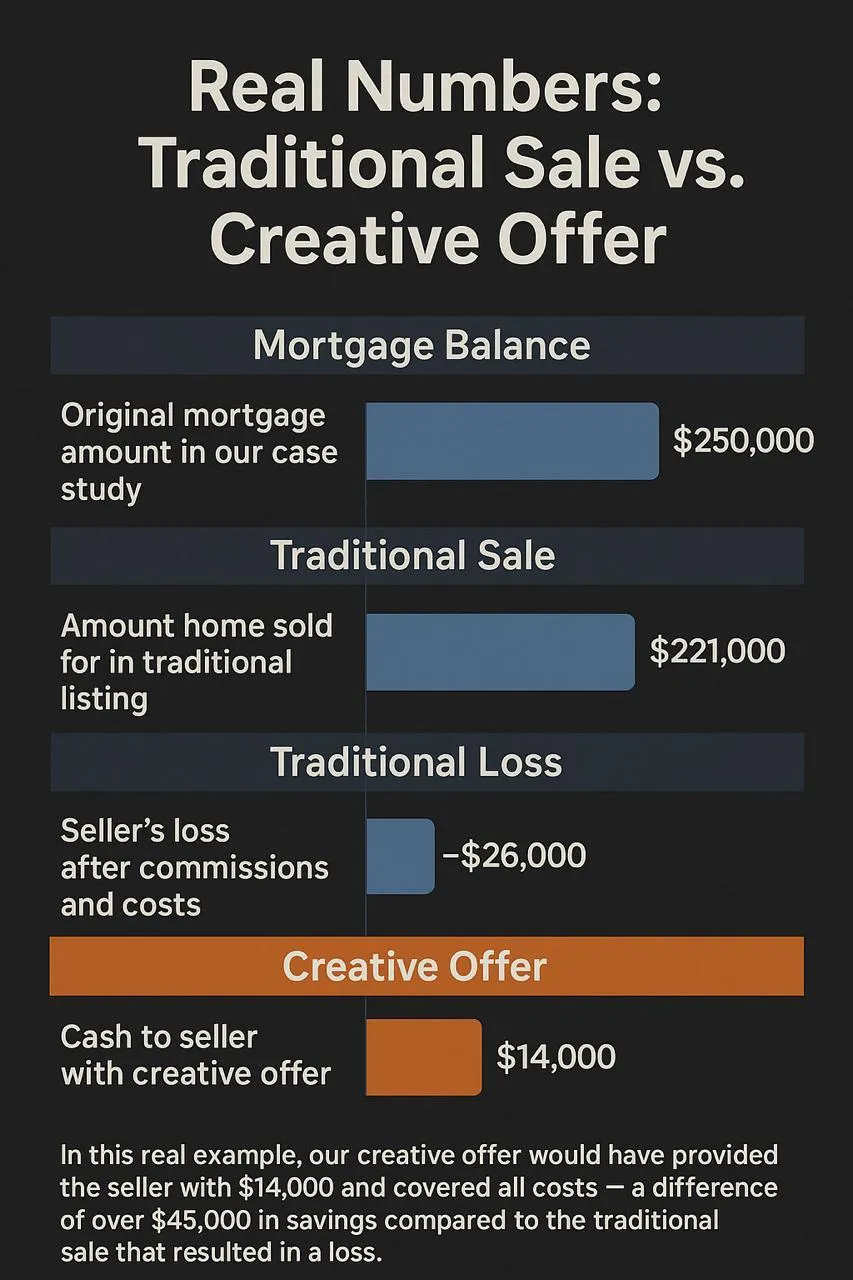

More Cash at Closing

Creative offers often yield more for sellers than retail sales, putting more money in your pocket when you need it most.

No More Responsibilities

Sellers walk away free from taxes, repairs, insurance, or upkeep, eliminating the ongoing burden of property ownership.

Credit Improvement

On-time payments made through a servicing company boost seller credit, helping you rebuild your financial standing.

Fallback Protection

"Deed in Lieu" options protect seller credit by reverting ownership if needed, providing peace of mind throughout the process.

What is Creative Real Estate?

All closings are handled by licensed real estate attorneys, ensuring complete legal compliance and protection for all parties involved.

Servicing Company

A licensed servicer makes payments and sends confirmations monthly, ensuring transparency and accountability..

Deed of Trust

Sellers retain a secured interest until the mortgage is paid in full, maintaining a legal claim to the property.

Promissory Note

Legally binding guarantee of buyer's performance, enforceable through legal channels if necessary.

Insurance

Full property insurance in place, protecting the asset value throughout the transaction period.

Title Closing Process

Contract Review

Review the contract with an attorney and gather all necessary documents including mortgage notes, payoff statements, and buyer/seller information forms.

Title Search

Title company performs a search, orders tax certificates, and sends commitment with outstanding items required for closing.

Preparation

Escrow officer prepares HUD-1 settlement statement and attorney prepares final closing documents.

Closing

Coordinate logistics for closing and return all signed documents to title for funding and recording.

Project

Here are just some of our projects. If you're interested in learning more about our work, you can schedule a meeting by phone, and we’ll be happy to answer all your questions.

Tucson, AZ 85718

SUBJECT TO

Single Family Home

SOLD

01.2025

Sarasota, FL, 34232

SELLER FINANCING

Single Family Home

SOLD

01.2025

Austin, TX 78741

SUBJECT TO

Single Family Home

SOLD

02.2025

Columbus, OH 43207

SUBJECT TO

Single Family Home

SOLD

09.2024

Lakewood, OH 44107

SUBJECT TO

Single Family Home

SOLD

11.2024

Lithonia, GA 30058

SUBJECT TO

Single Family Home

SOLD

11.2024

Our clients

Michael Harris, Ocala, FL

“Selling my house through Garner Lake Investments was easier than I ever imagined. They took over the mortgage, handed me the cash difference, and closed in two weeks—no repairs, no stress. I’m free of monthly payments and kept my credit intact. Huge thanks to the team!”

The Johnson Family, South Ogden, UT

“We were relocating out of state and dreaded a drawn‑out sale. The company laid out a clear offer: $40k at closing, they service the mortgage, and we receive the balance over five years at 3 %. Everything was signed online and paid on time. Best service we’ve experienced!”

Daniel Rogers, Investor, Austin, TX

“I purchased a turnkey Airbnb in Florida at a fixed 2.375 % rate through Garner Lake. They handled the entire cash‑flow analysis and property management setup; net income already beats projections. A game‑changer for passive investors.”

Sarah Mitchell, Crestline, CA

“No one wanted our mountain home with an existing loan, but Garner Lake crafted a hybrid ‘Subject To + Seller Finance’ solution. We got money in hand, minimal fees, and full legal support. I felt secure from the first call through closing.”

Emily Scott, Charlotte, NC

“After a divorce I needed out of my mortgage fast. Garner Lake Investments not only paid off the loan but wired the remaining funds straight to my account. Every step was explained in plain English—no legal fog. Highly recommend if you value speed and honesty.”

Kevin Thompson, First‑Time Investor, Phoenix, AZ

“I arrived with zero experience—terrified of real‑estate jargon. The team broke down ‘Subject To,’ guided me to my first deal, and wrapped everything in Garner Lake’s branding. They still answer my questions post‑closing and share performance reports. Grateful I chose them.”

FAQS

Is this legal?

Yes. All transactions follow federal real estate and escrow regulations. The HUD-1 form includes provisions for Subject-To and Wrap transactions.

How does this affect my ability to get a new loan?

We help you document non-payment of mortgage obligations with third-party proof, allowing many lenders to exclude this from your DTI. After 12 months of payments, most lenders fully remove the debt from DTI calculations.

Who covers repairs and maintenance?

Once the deed transfers, we become fully responsible — you are completely off the hook.

What if the lender calls the loan due (Due-on-Sale clause)?

Though extremely rare, we are prepared. We've never lost a home due to a due-on-sale issue. If invoked, we refinance, pay off the mortgage, or revert the property to the seller with no damage to their credit.